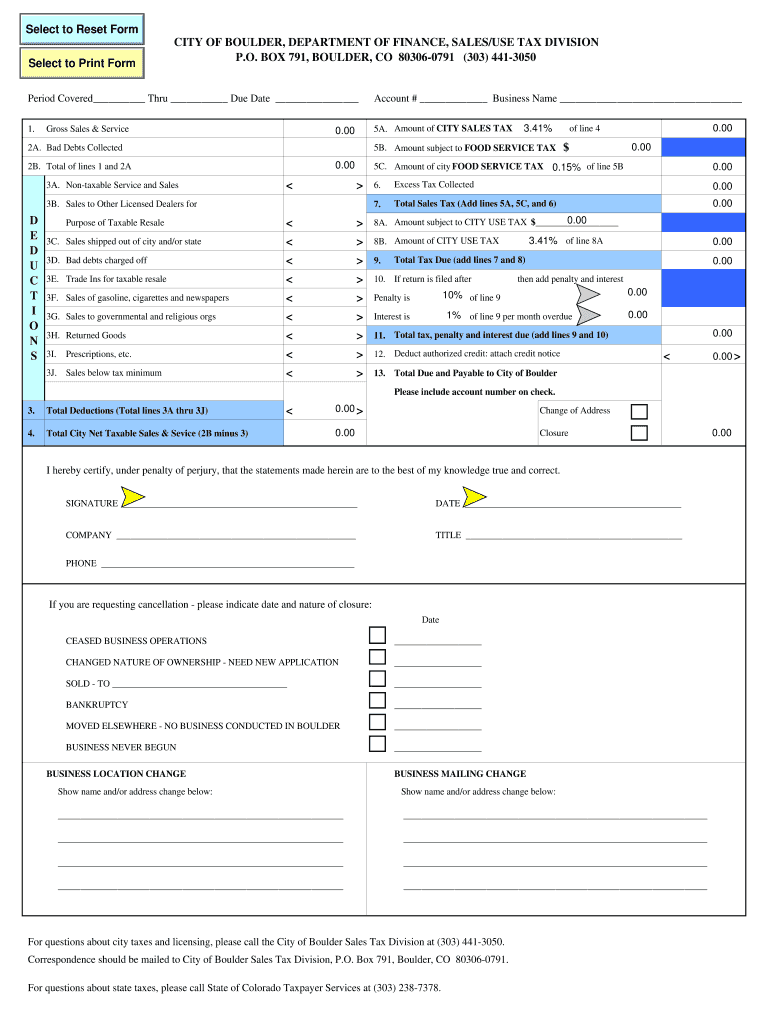

boulder co sales tax efile

Under 300 per month. 3460 Sales Tax or 3300 Use Tax.

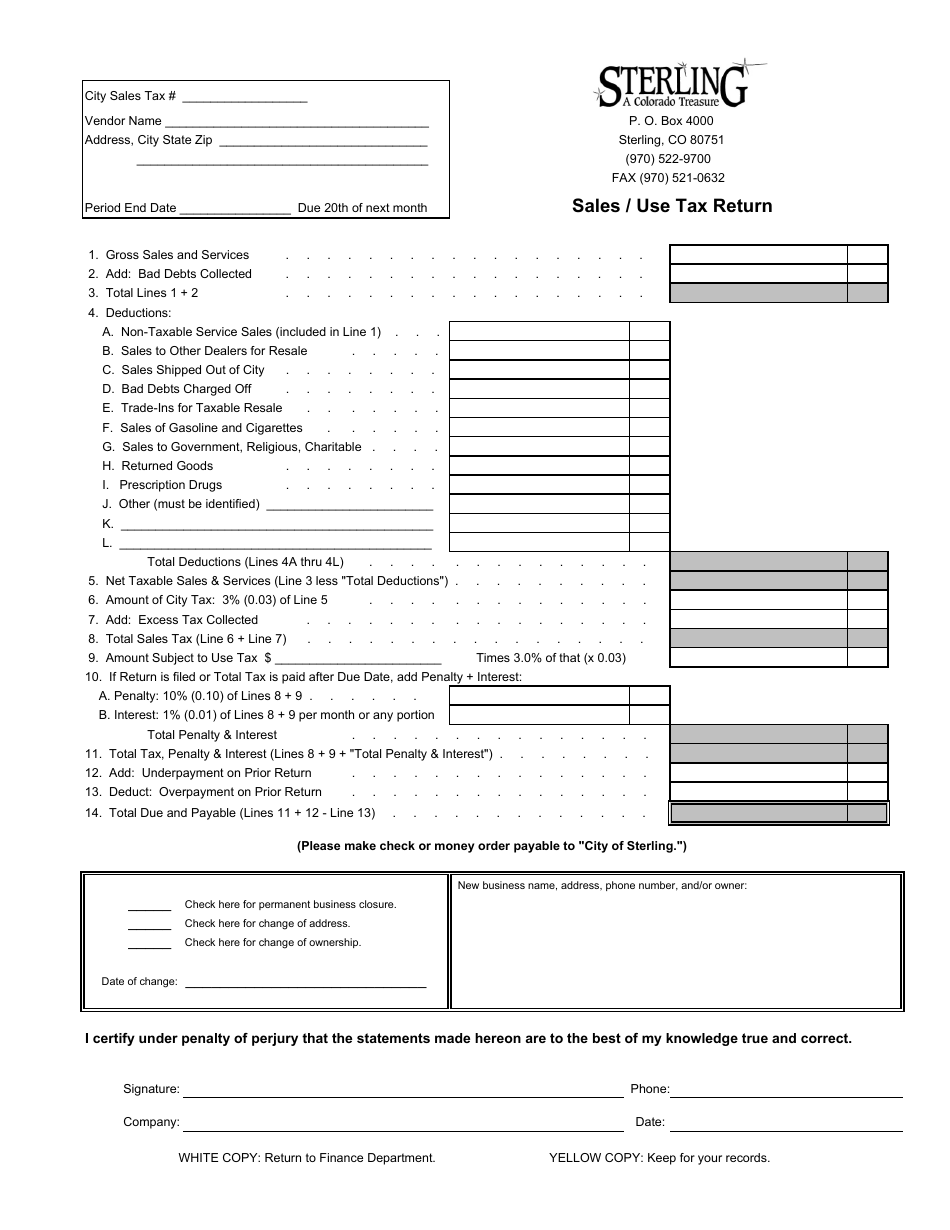

City Of Sterling Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

Senior Tax Worker Program.

. The Colorado state sales tax rate is currently 29. Online Sales Tax Filing. Postmark accepted for tax payments mailed to our office except tax lien redemptions.

Ad Avalara Returns for Small Business can automate the sales tax filing process. Copies of these licenses are available from CCO. Reconciliation is a process of filing a construction use tax return upon completion of a permitted construction project to determine whether there was an overpayment or underpayment of Construction Use Tax.

There are a few ways to e-file sales tax returns. Sales tax returns may be filed annually. For additional e-file options for businesses with more than one location see Using an.

The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans. Filing frequency is determined by the amount of sales tax collected monthly. The 2018 United States Supreme Court decision in South Dakota v.

Mobile Home Tax Lien Sale. The Treasurers Office collects taxes for real property mobile homes and business personal property. The Boulder sales tax rate is.

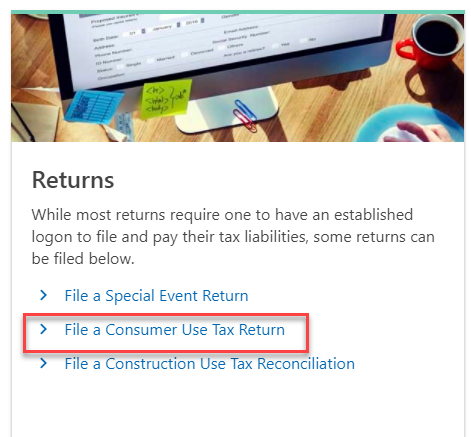

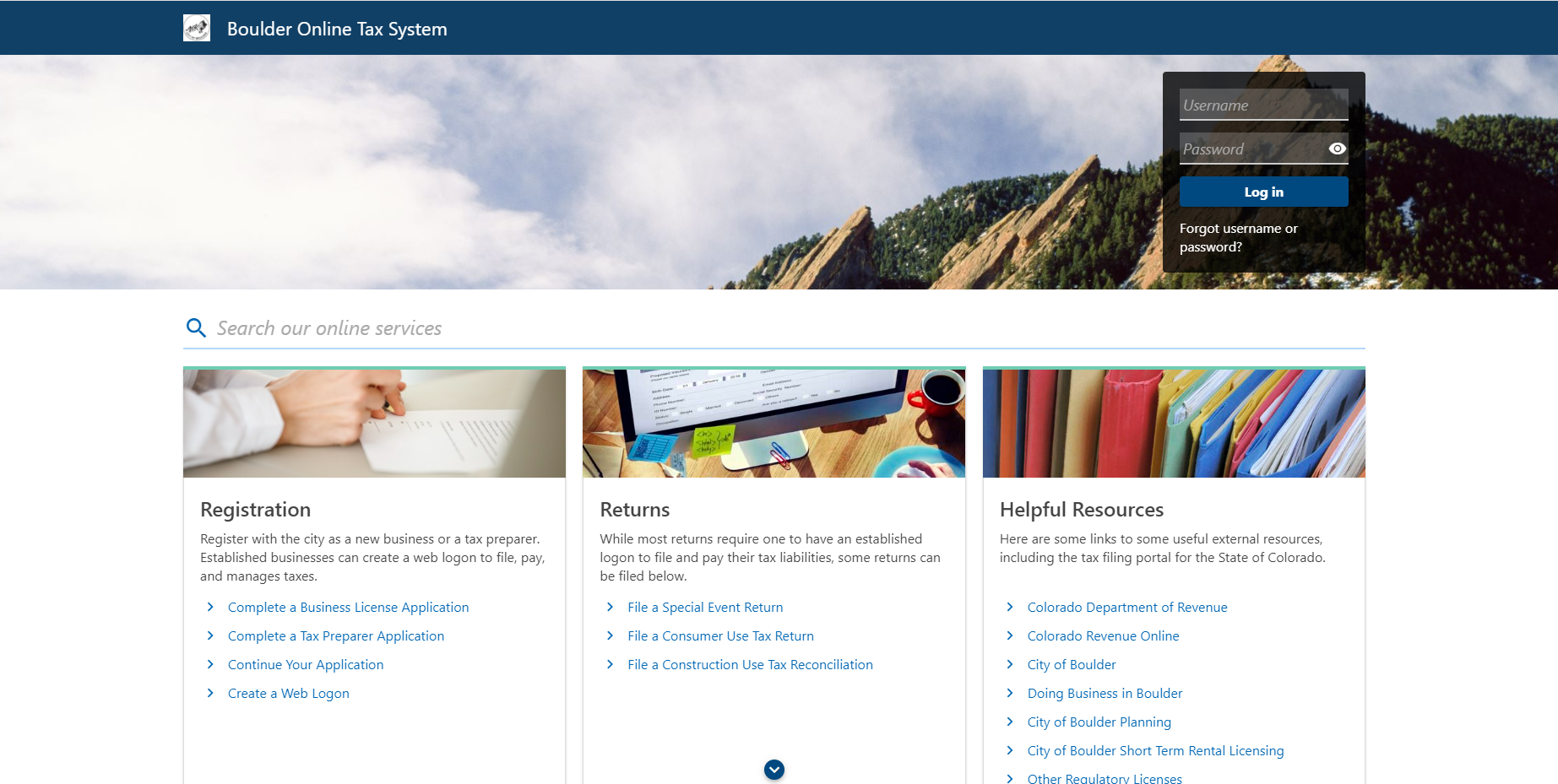

Boulder Online Tax System. If you need additional assistance please call 303-441-3050 or e-mail us at. Kailee Nicole Foerster 2338 14th Street Unit 2 Boulder CO 80304 949-409-5911.

3500 Sales Tax or 3000 Use Tax. 992 S 4th Ave. The Colorado sales tax rate is currently.

For assistance please contact the Sales Tax Office at 303-651-8672 or email SalesTaxLongmontColoradogov. Ad New State Sales Tax Registration. Our tax lien sale will be held December 2 2022.

Online filing is free. The city use tax rate is the same as the sales tax rate. Access and find resources about the Boulder Online Tax System below including how-to videos and PDF guides.

The December 2020 total local sales tax rate was 8845. Colorado Sales Tax Filing information registration support. Sales tax returns may be filed quarterly.

10 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. By e-mail at accountingcoloradoedy.

We allow e-check and credit card payments up to 600000. Colorado Sales Tax in Boulder CO. CU Boulder has its own State of Colorado Sales Tax License and City of Boulder Sales Tax License.

As permitted under CRS 39-10-1115 delinquent mobile home taxes may be struck off to the county rather than being offered for sale at auction. The minimum combined 2022 sales tax rate for Boulder Colorado is. The County sales tax rate is.

Saturday May 7 2022. Economic Nexus requires remote sellers with no physical nexus in Boulder to collect and remit sales tax on retail sales of tangible personal property commodities andor. Name A - Z Sponsored Links.

Boulder Details Boulder CO is in Boulder County. The current total local sales tax rate in Boulder CO is 4985. Filing of the return is required for all construction projects where the final contract price is 75000 or more.

Please contact your personal bank for ACH and electronic payment charges. Start your free trial today. CDOR is offering relief on state-collected taxes to Colorado taxpayers who have been affected by the Marshall Fire.

Colorado Tax Lookup Tool. Displaying the Sales Tax License. Has impacted many state nexus laws and sales tax collection requirements.

The Boulder County sales tax rate is 099. The State of Colorado allows property taxes to be paid either in two equal installments or in full by the dates shown below. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online.

Information about City of Boulder Sales and Use Tax. Colorado Department of Revenue. Starting at just 19month for sales tax preparation.

In 2007 voters approved an extension of the sales tax through 2024. February 28 June 15. Boulder co sales tax efile.

4000 Sales Tax or 3000 Use Tax. No discounts for early payment. In 2001 the voters of Boulder County passed a ballot issue that allowed for a 01 percent one cent on a 10 purchase countywide transportation sales tax.

To review the rules in Colorado visit our state-by-state guide. There is a one-time processing fee of 25 which may be paid by cash or check. Operations that charge sales tax are required to post a current copy of each license in a conspicuous place.

This is the total of state county and city sales tax rates. The Transportation Sales Tax helps fund. This ordinance was developed by home rule municipal tax professionals in conjunction with the business community and the Colorado Department of Revenue as part of a sales tax simplification effort.

This is the total of state and county sales tax rates. Payment Due Dates for 2022 Two half payments. Annual returns are due January 20.

With proof of payment sales tax paid to another tax jurisdiction may be credited against consumer use tax due for a particular item. Ad Automate Standardize Taxability on Sales and Purchase Transactions. Consumer Use Tax How To File Online Department Of Revenue Taxation.

Integrate Vertex seamlessly to the systems you already use. - January 5 2022 - The Colorado Department of Revenue CDOR understands some taxpayers will be unable to meet Colorado filing and payment deadlines as a result of the recent Marshall Fire. Use tax is intended to protect local businesses against unfair competition from out-of-city or state vendors who are not required to collect City of Boulder sales tax.

15 or less per month. If you have more than one business location you must file a separate return in Revenue Online for each location. The tax relief measures will mirror IRS measures in the.

Businesses in Related Categories to Taxes-Consultants Representatives. Return the completed form in person 8-5 M-F or by mail. E-check payments are free and credit card payments are assessed a 239 fee with a 150 minimum which is paid to the payment processing company.

Boulder Online Tax System Help Center City Of Boulder

Sales And Use Tax City Of Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales Tax Boulder Form Fill Out And Sign Printable Pdf Template Signnow

Sales Tax Campus Controller S Office University Of Colorado Boulder

Construction Use Tax City Of Boulder

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

File Sales Tax Online Department Of Revenue Taxation

Tax Services Denver Boulder Local Experts

Co Sales Tax Return City Of Boulder Fill Out Tax Template Online Us Legal Forms